Five eCommerce KPIs Your Accountant Should be Tracking for You

What isn’t measured, isn’t managed. While this is true for every business, it’s especially crucial in eCommerce.

Why? Because the success of your eCommerce store is largely based on unit economics, and almost everything in eCommerce is measurable.

Your costs, your revenue, and subsequently your margins, can be broken down for every item in your store.

Not just that, in this day and age, virtually every step of your buyer’s journey can be tracked with free tools like Google Analytics. Online platforms like Shopify will even give you data about your checkout process. Put that data together, add in financial costs from your accounting software, and you can breakdown your unit economics in real-time.

It can all be optimized.

But the fact everything can be tracked is both a gift and a curse. Metrics and KPIs can often become distracting, it’s important to focus on what’s most important to your business right now. It’s important to optimize one area of your store at a time.

So where do you start the analysis? Here are five major KPIs (and a whole bunch of supporting KPIs) you and your accountant should be tracking on a monthly basis.

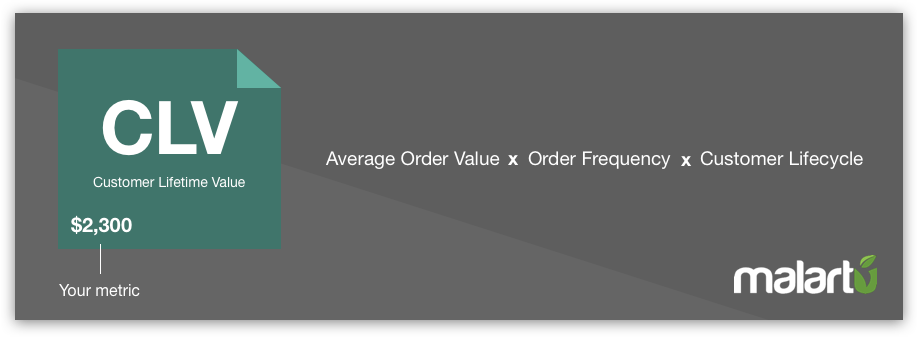

Customer Lifetime Value

First, you need to understand how much each new customer is worth to you. Customer lifetime value is calculated by multiplying the average someone spends with you, how many times they order from you in a year, and how many years they typically buy from you.

If you’re a new store, your average number of orders and average customer lifecycle may be a bit of an estimate, but you can deduce these figures depending on what you sell.

If you sell pens to school teachers, do you expect them to buy every year? For how many years? How many times per year?

Your average order value, on the other hand, is something you can track closely on an ongoing basis.

Average order value

Average order value is calculated by dividing your total number of orders by revenue from product sales in a given period.

While average order value is a core component to understanding the value of every customer, it’s also a good indicator of up-sells and cross-sells.

Average order value going up? That means you’re doing a good job of encouraging impulse buys, or recommending related items for your customers.

Customer Acquisition Cost

Now that you know what your customer is worth, you need to understand how much they cost. Calculate your customer acquisition cost by dividing the cost to acquire a new customer by the number of new customers in a given period.

But this is a very general definition of acquisition cost. There are two very important distinctions for customer acquisition costs: do you include all customers, or just those customers acquired by paid channels?

CAC Fully Blended

A fully blended CAC includes all costs directly allocable to customers, such as marketing & commercial expenses and wages, their related operating costs, and dedicated capex. This is then divided by all new customers in a given period, including those acquired by organic channels that were not directly influenced with paid advertising.

Paid Only CAC

Paid CAC more accurately reflects how effective your paid channels are because it only takes into account customers that were acquired from paid channels.

Paid CAC thus excludes new subscribers reached through referral or expansion in your customers account. According to a16z (one of the most successful VCs of all time) this KPI is more likely to show your ability to scale.

Investors often care about paid CAC over fully blended CAC because it informs whether a company can scale up its user acquisition budget profitably.

An important note from a16z on growth:

“Counterintuitively, it turns out that costs typically go up as you try and reach a larger audience. So it might cost you $1 to acquire your first 1,000 users, $2 to acquire your next 10,000, and $5 to $10 to acquire your next 100,000. That’s why you can’t afford to ignore the metrics about volume of users acquired via each channel.”

CAC/LTV Ratio

Ready to simplify this even more? Take a look at your CAC to LTV ratio to get an ultra-high level view of the health of your business. Ideally, LTV/CAC should be greater than 3, which means you should make 3x on each customer of what you would spend in acquiring them.

Conversion Rate

Now that you understand your unit economics for each customer, it’s time to start looking at how to get more of them. The most important KPI for understanding growth opportunity is conversion rate.

Calculate your conversion rate by dividing the number of orders by the number of visits to your website in a given period.

At a high level this is certainly helpful, but you can uncover more specific areas for website optimization by understanding the conversion rate by product line, traffic channel, and marketing campaigns.

Top Traffic Sources

So you know what products convert best, on what page, from what type of messaging, but where is this traffic coming from?

For example, it’s impossible to improve the conversion rate on a given page if you don’t know what type of page your visitors are seeing.

It could be that your highest traffic source in the US is mobile. Your short term goal should be to improve the mobile experience for your english speaking visitors. Move backward through your traffic sources from here.

Cart Abandonment Rate

By now you’re probably already thinking of a plan to improve your eCommerce store, but you’re also thinking, “this is going to be a lot of work.”

It is, but you know what would be worse? Attracting a repeat buyer to your optimized mobile eCommerce store, successfully cross-selling them (upping their order value) and then have them abandon their shopping cart.

Ooph. That’s rough.

Understanding your cart abandonment rate is low-hanging fruit and crucial to your success. The last thing you want to do is hit every step with someone just to have them drop out of a lousy checkout experience.

Calculate your cart abandonment rate by dividing the number of checked out carts by total number of carts in the store

What isn’t measured, isn’t managed. While this is true for every business, it’s especially crucial in eCommerce. Why? Because the success of your eCommerce store is largely based on unit economics, and almost everything in eCommerce is measurable.