In a survey conducted by Bloomberg, nearly 97% of respondents reported their companies have adopted analytics. The three most popular goals were the ability to reduce costs, increase profitability and improve risk management.

Leading indicators best represent the business’s headlights and tell you where the company is going and what obstacles to watch out for. By the time your financial statements alert you to an issue, it’s too late, but by mixing certain operational data points with financial data you can provide leading indicators for your team to avoid pitfalls.

Read MoreImagine this. You, the managing partner of an asset management firm, are sitting at your desk and get a request from an LP for information detailing the past 5 years of Q1 financial data for a specific company. Sure, this doesn’t happen often (or ever for some), but what if it did? Would you be prepared?

Read MoreLike any real estate operation, there is data flowing everywhere: from weekly leasing reports to FMV and return data. Origin Investments focuses on constantly improving their aggregation and reporting processes so that they can continue to differentiate the Origin investor experience from that of a traditional fund.

Read MoreAn interview with Jim Bolduc, Senior Managing Director at JPB Partners about the opportunities and challenges facing consumer-focused private equity investors

Read MoreMaintaining GP and LP alignment is a challenge. We discuss the various ways to mitigate misalignment through data and reporting.

Read MoreThink back to the interview you did for the current job you’re working at. You most likely got your job from your work experiences and accomplishments, not the clothes you wore that day or the paper you presented your resume on.

Read MoreInvestors working with private companies experience the same free and ubiquitous access to data that much of the tech industry realized in the late 2000’s but have yet to capitalize on the opportunity. If you take a random sample of fund managers and ask them how they leverage data from due-diligence, portfolio monitoring, or their own fund’s operation, the answer generally encompasses a mix of analysts, cumbersome excel files, and CRMs. The data is available but locked in an antiquated system. Herein lies the opportunity.

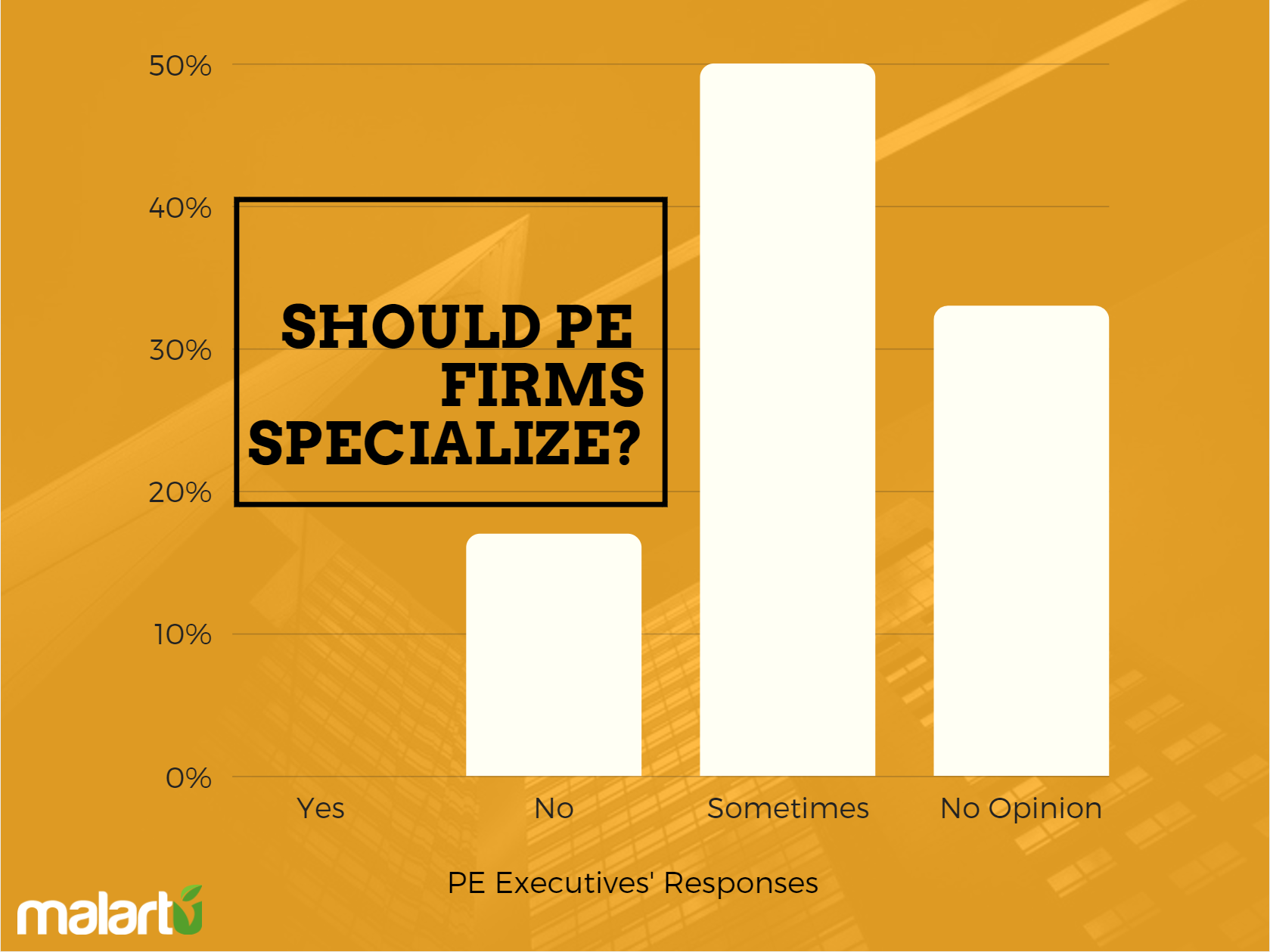

Read MoreMalartu sat down with twelve executives from PE and mezzanine funds and a handful of limited partners to talk current investment trends such as specialization, operating partners, co-investment, and secondary transactions. Read more to find out what we learned.

Read MoreLike traditional debt, mezzanine funds lend out money and in return expect a series of payments with added interest sometime in the future.

Read MoreTo understand why the top private equity firms are like nurseries, we have to listen to Jack Dangermond, famed businessman and environmental scientist who said:

"In a nursery, if you don't take care of those plants, your profits get lost real quickly. You have to weed. You have to water. You have to nurture.”

Read MoreIf you read our newsletter and weekly update, you’ll quickly learn that we like data, and we like ranking things. Given our approach to middle market portfolio tracking, we set out to rank the top 10 areas to invest in middle market businesses. We’ll call these “high-growth, low-hype” markets, a phrase first coined by the co-founders of Frontier Capital, Richard Maclean and Andrew Lindner. But before we get to ranking, let’s talk briefly about high-growth, low-hype, and the middle market.

Read More